Business Insurance in and around Union

Calling all small business owners of Union!

Cover all the bases for your small business

Your Search For Reliable Small Business Insurance Ends Now.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all on your own. As someone who also runs a business, State Farm agent Max Smirnov is aware of the work that it takes and would love to help lift some of the burden. This is insurance you'll definitely want to learn more about.

Calling all small business owners of Union!

Cover all the bases for your small business

Surprisingly Great Insurance

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is temporarily closed. It not only protects your compensation, but also helps with regular payroll costs. You can also include liability, which is vital coverage protecting your company in the event of a claim or judgment against you by a customer.

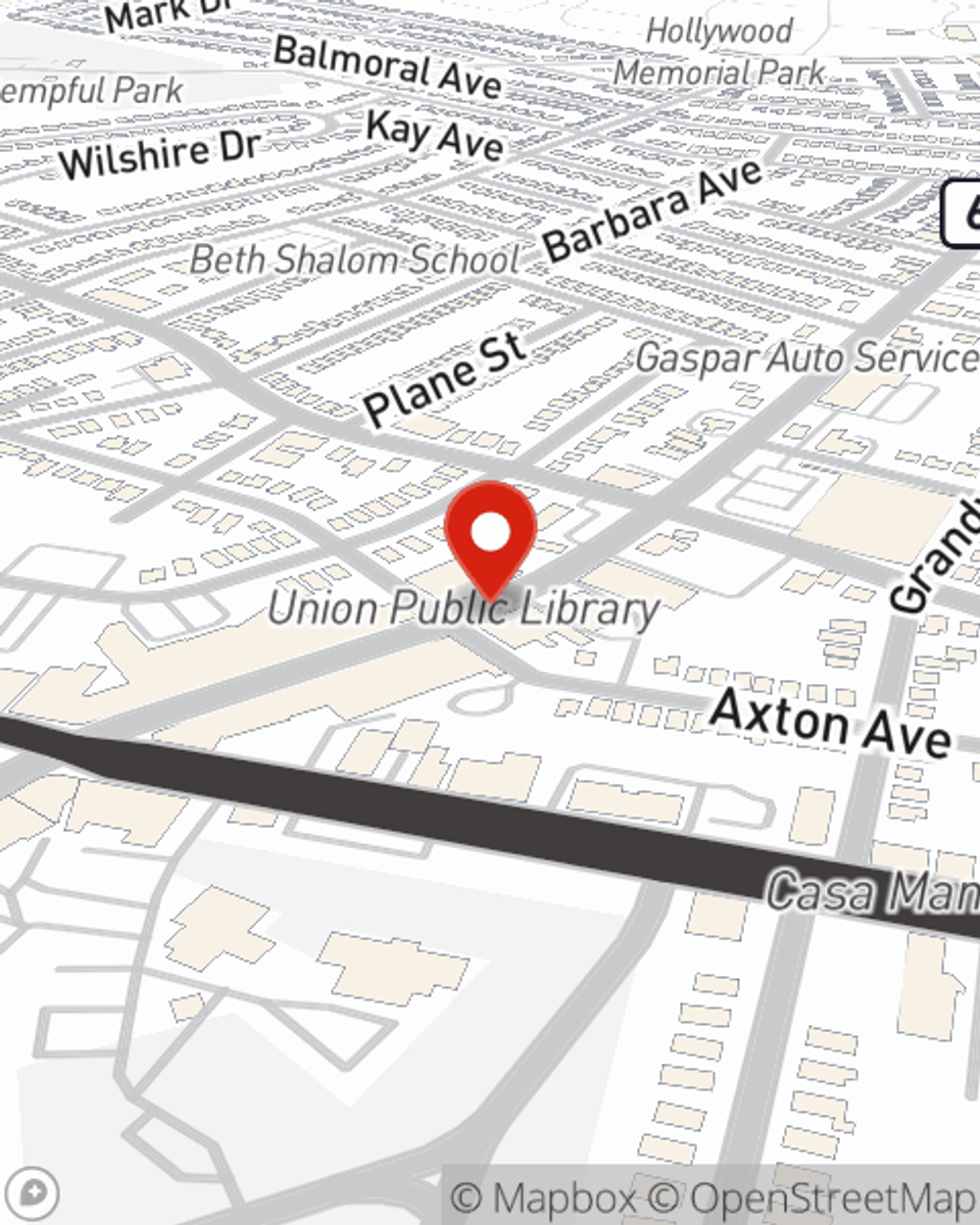

Call or email State Farm agent Max Smirnov today to learn more about how a State Farm small business policy can safeguard your future here in Union, NJ.

Simple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Max Smirnov

State Farm® Insurance AgentSimple Insights®

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.